You as a QuickBooks user may or may not understand the purpose of Undeposited Funds in the software. Hopefully, if you’re not too sure how to use it, after this short article, you’ll better utilize the feature and you’ll wonder how you ever did without it before!

The purpose of Undeposited Funds is to help you later during your reconciliations. Let’s begin with an example.

Maybe you’re like me and you deposit at your bank once a week. If you do, a physical deposit slip can itemize multiple payments from customer receivables into one lump sum deposit. Without Undeposited Funds, you will receive payments individually that could cost you time trying to figure out the sum of multiple payments into one deposit.

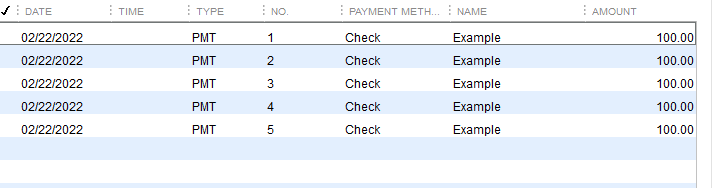

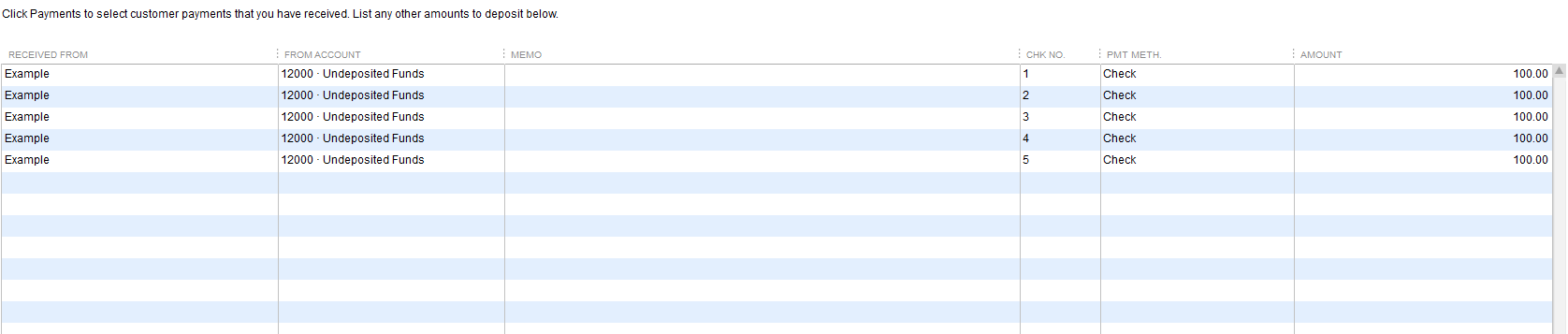

Let’s say I received five $100.00 checks from five different customers, one each day of the week and I’m ready to make out my deposit slip Friday before I deposit at the bank on my way home.

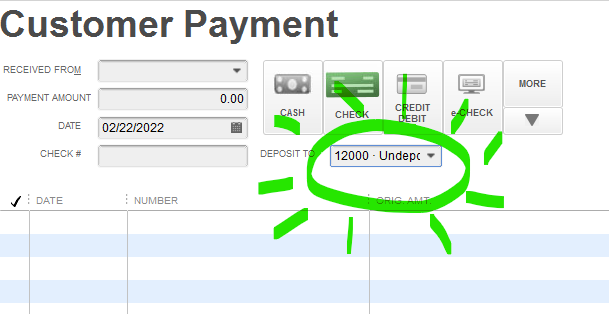

First, I will go to my “Receive Payments” icon in QuickBooks, itemize the payment from each check, and I’m going to select “Undeposited Funds” in the drop down for each transaction.

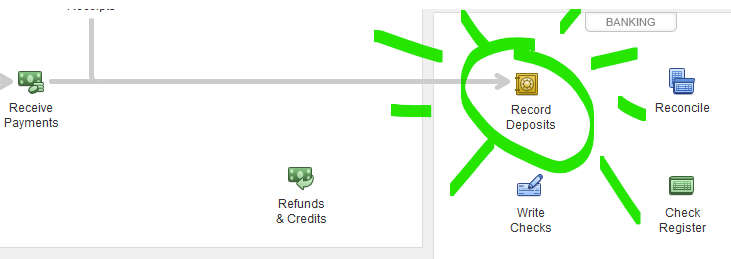

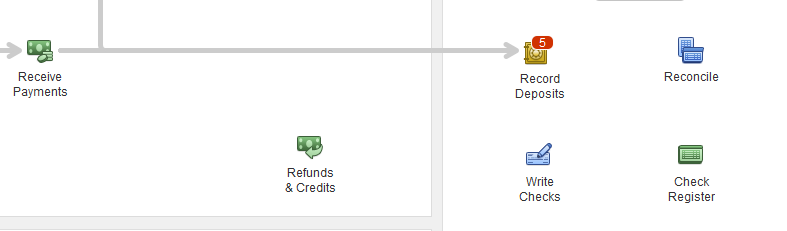

After I have received all five payments, I will choose the “Record Deposits” icon and I will see all five payments, selecting them and the bank account from the drop down. I will save and close.

If I next go into my bank account, I will see a deposit of $500.00 rather than five single $100.00 deposits.

This is helpful because when I go to reconcile, the bank statement and my QuickBooks register will match making my task simpler and more efficient.