The end of the year is approaching. There are two good things to review every year to help with your financial knowledge and growth. One is reviewing your social security statements. The other is to review your credit report.

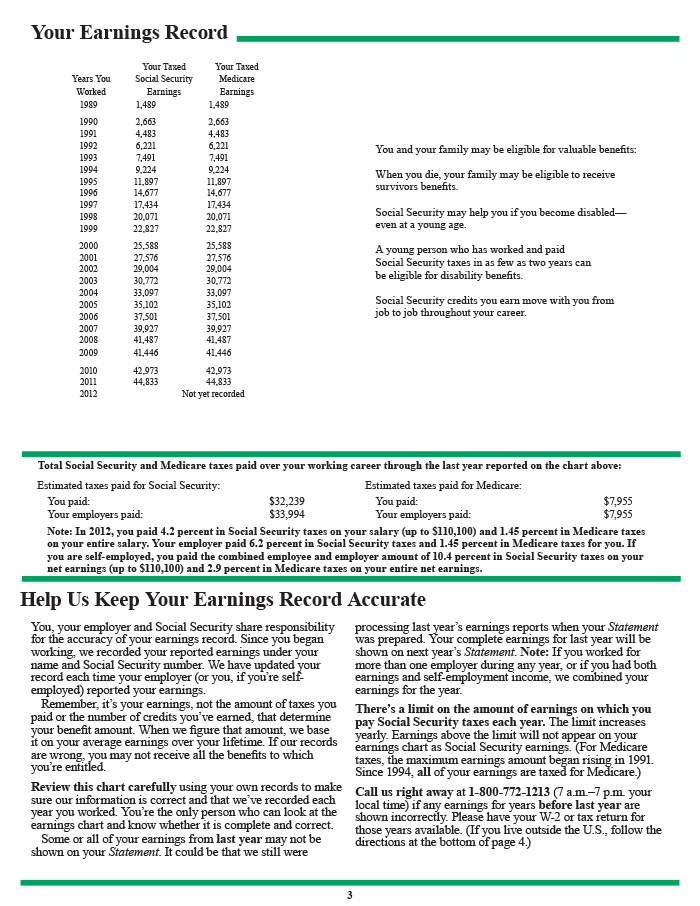

Social Security statements – receive a yearly Social Security statement. Good tool to have to estimate what your retirement benefits are projected to be when you reach retirement age. This can help you even if you are not near retirement age. It is always better to plan early. The sooner you get started planning and saving for the future the better. You can receive one by logging into the Social Security website at:

Social Security statements – receive a yearly Social Security statement. Good tool to have to estimate what your retirement benefits are projected to be when you reach retirement age. This can help you even if you are not near retirement age. It is always better to plan early. The sooner you get started planning and saving for the future the better. You can receive one by logging into the Social Security website at:

https://www.ssa.gov/onlineservices/

Click on Get your social security statement. You will have to create a Social Security account to be able to view your statement online.

Your statement will show you personalized estimates of future benefits based on your real earnings. You can also review your earnings history.

Credit reports – Credit reports contain information about your bill payment history, loans, current debt, and other financial information. They show where you work and live and whether you’ve been sued, arrested, or filed for bankruptcy.

Credit reports help lenders decide whether or not to extend you credit or approve a loan, and determine what interest rate they will charge you. Prospective employers, insurers, and rental property owners may also look at your credit report.

It’s important to check your credit report regularly to ensure that your personal information and financial accounts are being accurately reported and that no fraudulent accounts have been opened in your name. If you find errors on your credit report, take steps to have them corrected.

There are three credit reporting agencies, Experian, Equifax, and TransUnion. You can access your credit report by logging into the following website:

https://www.usa.gov/credit-reports

Scroll down to the section that is titled Request your free credit report. It details three different ways you can access your credit report. Under the section titled Credit Reporting Agencies there is information on what your credit report contains and how you can fix errors if they exist.

Written by Diane Hessenius,

Written by Diane Hessenius,

Senior Tax Preparer at Perfect Balance Accounting Services LLC